Recent and projected large federal budget deficits have generated congressional and executive branch interest in increasing revenue by reducing the tax gap. Specific methods for lowering the tax gap may also be used as revenue offsets under the Pay-As-You-Go Act (PAYGO). Other motivations for reducing tax gaps include adverse effects on (1)public trust in the fairness of the tax system, which may adversely affect voluntary compliance with tax laws, and (2) economic efficiency, by providing an incentive for inputs of labor and capital to shift to those sectors of the economy with greater opportunities to evade taxes. This book defines tax gap concepts, explains the methodology used to estimate the tax gap, discusses the relationship between the tax gap and enforcement, explains the Internal Revenue Service’s (IRS’s) strategic priorities, examines the IRS return prepayer initiative, and describes proposed legislation in the 112th Congress.

Rondell Meinke

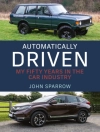

Tax Gaps [PDF ebook]

Reduction Strategies, Compliance Efforts and Legislative Proposals

Tax Gaps [PDF ebook]

Reduction Strategies, Compliance Efforts and Legislative Proposals

Koop dit e-boek en ontvang er nog 1 GRATIS!

Formaat PDF ● Pagina’s 154 ● ISBN 9781624174537 ● Editor Rondell Meinke ● Uitgeverij Nova Science Publishers ● Gepubliceerd 2016 ● Downloadbare 3 keer ● Valuta EUR ● ID 7222390 ● Kopieerbeveiliging Adobe DRM

Vereist een DRM-compatibele e-boeklezer